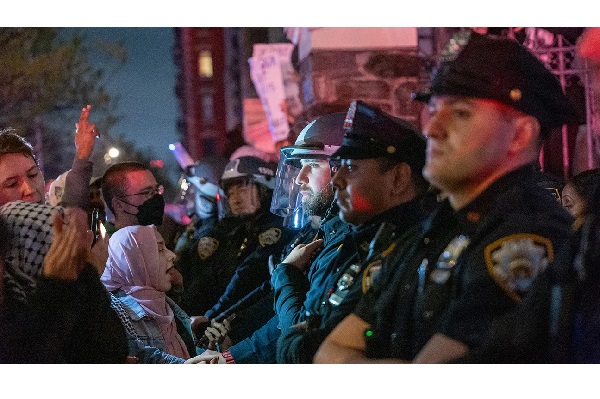

LOS ANGELS: Police forcibly removed scores of defiant pro-Palestinian protesters at several colleges on Thursday, including taking

ISLAMABAD: The International Monetary Fund (IMF) confirmed on Thursday that it had reached a staff-level agreement with Pakistan on the combined seventh and eighth reviews for a $6 billion loan facility, a development that paves the way for the release of the much-awaited $1.17bn.

The deal materialised after Pakistan met the IMF demand that the country achieve a primary budget surplus of Rs152 — 0.2bn per cent of the national output for the new financial year — to revive the bailout package.

In a statement on its website, the IMF said the agreement was subject to approval by its Executive Board.

“The IMF team has reached a staff-level agreement (SLA) with the Pakistan authorities for the conclusion of the combined seventh and eight reviews of the EFF-supported programme. The agreement is subject to approval by the IMF’s Executive Board,” the IMF statement read.

It added: “Subject to Board approval, about $1,177 million (SDR 894 million) will become available, bringing total disbursements under the programme to about $4.2 billion.”

The international money lender said a team led by IMF mission chief to Pakistan Nathan Porter finalised the discussions with Pakistan and that it had also agreed to consider extending its Extended Funded Facility (EFF), currently worth $6bn, till the end of June 2023, as well as augmenting it by $720m to expand its size to $7bn.

This decision, it explained, was taken to support the programme’s implementation, meet Pakistan’s higher financing needs in FY23 and as well as catalyse additional financing.

The announcement by the IMF comes after Finance Minister Miftah Ismail told Dawn on Wednesday that talks with the money lender had concluded and “they (IMF) are now going through their internal approval process”.

He said an announcement from the IMF on the successful completion of the seventh and eighth quarterly reviews of the stalled loan programme was expected soon.

Soon after the IMF confirmed the development today, Miftah shared the news on Twitter and thanked Prime Minister Shehbaz Sharif, “my fellow ministers, secretaries, and especially the finance division, for their help and efforts in obtaining this agreement”.

In its statement issued today, the IMF noted that “Pakistan is at a challenging economic juncture”.

“A difficult external environment combined with procyclical domestic policies fuelled domestic demand to unsustainable levels,” it said, adding that the resultant economic overheating led to large fiscal and external deficits in FY22, contributed to rising inflation, and eroded reserve buffers.

In light of this, the money lender outlined “policy priorities” for Pakistan to “stabilise the economy and bring [its] policy actions in line with the IMF-supported programme”’.

These priorities include the steadfast implementation of budget for the current fiscal year, reforms in the power sector, working out a monetary policy to bring down inflation to “moderate levels”, reducing poverty and strengthening governance.

With regards to the budget for fiscal year 2022-23, the IMF noted that it aimed to “reduce the government’s large borrowing needs by targeting an underlying primary surplus of 0.4 per cent of GDP (gross domestic product), underpinned by current spending restraint and broad revenue mobilisation efforts focused particularly on higher income taxpayers”.

“Development spending will be protected, and fiscal space will be created for expanding social support schemes” under the new budget, it said, adding that the provinces had agreed to support the federal government’s efforts to reach the fiscal targets, and memoranda of understanding had been signed by each provincial government to this effect.

The IMF further highlighted that due to the “weak implementation” of the plan previously agreed with it, Pakistan’s power sector circular debt flow was expected to “grow significantly” to around Rs850bn in FY22, “overshooting programme targets, threatening the power sector’s viability, and leading to frequent power outages”.

Therefore, it said, Pakistani authorities were committed to resuming reforms in the power sector, including, “critically, the timely adjustment of power tariff”.

This adjustment, it added, covered the “delayed annual rebasing and quarterly adjustments, to improve the situation in the power sector and limit load shedding”.

On the recent monetary policy increase — wherein the State Bank of Pakistan increased the interest rate by 125 basis points to 15pc — the IMF termed the measure “necessary and appropriate” as the headline inflation exceeded 20pc in June, hurting particularly the most vulnerable.

The IMF stressed that the monetary policy “will need to be geared towards ensuring that inflation is brought steadily down to the medium-term objective of five per cent to seven per cent”.

It further emphasised that the rates of Export Finance Scheme (EFS) and Long Term Financing Facility (LTFF) — two major financing schemes — “will continue to be linked to the policy rate” to enhance the monetary policy transmission. In this connection, the IMF statement mentioned that the rates for EFS and LTFF had been raised by 700 bps and 500 bps respectively over the recent months.

“Greater exchange rate flexibility will help cushion activity and rebuild reserves to more prudent levels,” the IMF said.

With regards to poverty alleviation, the IMF statement detailed that during FY22, “the unconditional cash transfer [under the] Kafalat scheme reached nearly 8 million households, with a permanent increase in the stipend to Rs14,000 per family, while a one-off cash transfer of Rs2,000 (Sasta Fuel Sasta Diesel, SFSD) was granted to about 8.6m families to alleviate the impact of rampant inflation”.

“For FY23, the authorities have allocated Rs364bn to BISP (up from Rs250bn in FY22) to be able to bring nine million families into the BISP safety net, and further extend the SFSD scheme to additional non-BISP, lower-middle class beneficiaries,” it added.

The IMF further said: “To improve governance and mitigate corruption, the authorities are establishing a robust electronic asset declaration system and plan to undertake a comprehensive review of the anticorruption institutions (including the National Accountability Bureau) to enhance their effectiveness in investigating and prosecuting corruption cases”.

Pakistan entered the IMF programme in 2019, but only half the funds have been disbursed to date as Islamabad has struggled to keep targets on track.

You May Also Like

WASHINGTON: The US State Department said on Thursday that Washington supports Pakistan’s efforts to stabilise its economy,

KARAKORAM: At least 20 people died while 21 others were injured on Friday morning when a passenger bus overturned on the