NEW DELHI: Indian police said on Saturday they had arrested the social media chief of the country’s main opposition party over accusations

KARACHI: Tensions with Iran and Afghanistan could lead to uncertainty in the country and destabilise the exchange rate, as the demand for dollars will rise, said currency dealers in Karachi.

A currency dealer mentioned that the grey market, which had disappeared after the crackdown, started showing activity on Thursday.

“I am not sure about the grey market activity. If the situation leads to more uncertainty, it could be exploited by the grey market players,” said Zafar Paracha, General Secretary of the Exchange Companies Association of Pakistan (ECAP).

However, he denied having any information about the grey market activity and emphasised that the market should be alert.

The crackdown on illegal currency business and smuggling of dollars and goods to Iran and Afghanistan helped government efforts to stabilise the exchange rate.

However, debt servicing has depleted the State Bank of Pakistan’s foreign exchange reserves before receiving the expected $705 million inflow from the IMF.

The SBP reported a $127 million decline in foreign exchange reserves to $8.027 billion for the week ending on Jan 12, 2024.

The SBP stated that the decrease in reserves was due to debt repayment. The country will have to pay about $24bn for debt servicing during the current fiscal year, FY24.

Recent external developments in the economy have raised hopes for Pakistan to receive the last tranche of $1.2bn from the IMF in March. The UAE has already announced a rollover of $2bn placed with the SBP for one year.

In conjunction with these developments, the current account posted a surplus of $397m in Dec 2023, enabling the government to maintain a stable exchange rate with improved foreign exchange reserves.

The exchange rate has been stable for the last couple of months, with a gradual appreciation of the rupee against the US dollar. However, on Thursday, the dollar traded below Rs280, considered a psychological barrier.

The SBP reported the closing price of the dollar in the interbank market at Rs279.98, compared to Rs280.10 the day before; PKR appreciated by 12 paise.

Currency dealers are confident that the exchange rate will remain stable due to future inflows and the rollover of debts. However, they mention that recent developments on borders with Iran and the ongoing situation with Afghanistan could alter the economic and exchange rate scenario.

While the open market could be the first to react to developments on Pakistan’s borders, the market remained calm since the price remained almost unchanged.

You May Also Like

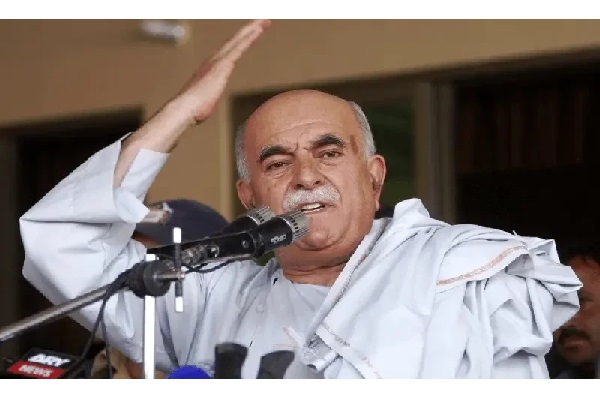

LAHORE: A delegation of Tehreek-i-Tahafuz-i-Aien (movement for protection of constitution), led by its president Mahmood Khan Achakzai,

LAHORE: As Prime Minister Shehbaz Sharif pledges to “protect the interests of farmers at all costs”, the federal government appears reluctant