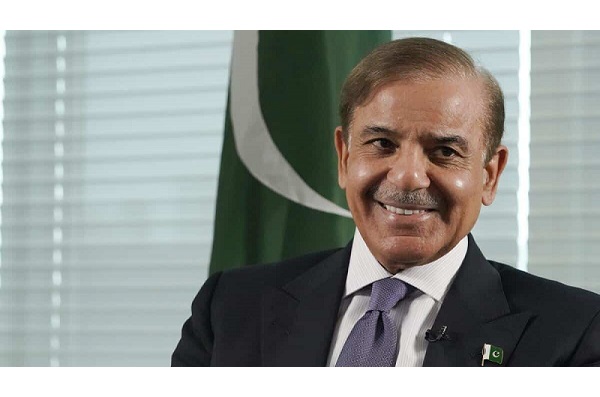

ISLAMABAD: Prime Minister Shehbaz Sharif would be visiting Saudi Arabia for the second time in a month, on April 27 for three days,

KARACHI: The State Bank of Pakistan directed banks to provide free of cost digital fund transfer services to individual customers up to, at least, a minimum aggregate sending limit of Rs25,000 per month per account or wallet. However, banks may choose to set this aggregate limit at a higher amount as well. This would allow individual customers to make as many free fund transfer transactions remaining within their aggregate monthly limit of free transfers.

For transactions above the aggregate limit of Rs25,000 per account in a month, banks may charge individual customers, a transaction fee of no more than 0.1 per cent of the transaction amount or Rs200, whichever is lower. This will enable service providers to recover part of costs they incur on providing inter-bank fund transfer service and build sustainable and innovative business models.

“Surely banks will make money with this decision while it would be slightly discouraging for the stakeholders. But it is not possible to go back to the chequebook system,” said Samiullah Tariq, Head of research at Pakistan Kuwait Investment (PKI).

At the same time, the digital system provides extra facility to make payment or withdraw cash without going to the bank with stress of bank’s timing in mind, he added.

During the 1st quarter FY21 review, PRISM (Pakistan Real-time Interbank Settlement Mechanism) processed 972,000 transactions valuing Rs92.2 trillion. These transactions showed a quarterly increase of 36 per cent by volume while it showed decrease of 1pc by value. In addition to the interbank funds transfers (settlement transactions between participating institutions), PRISM has also facilitated customers through its customers’ transfers’ facility which accounts for the largest share of 89pc in the total volume of PRISM transactions whereas the government securities transfers’ facility has the largest share of 65pc in terms of value of transactions as at the end of the 1st quarter.

During the quarter under review, e-banking channels ie RTOBs, ATM, POS, eCommerce, Banking through mobile phone, internet and call centres altogether processed 253.7 million transactions of value Rs19.1tr. In total number of e-banking transactions, ATMs have the highest share ie 53pc in volume of transactions. While in the 2nd quarter of FY21, a total of 296.7m transactions valuing Rs21.4tr were processed. ATMs processed the majority chunk with 51pc.

During the quarter under review, PRISM processed around 1m transactions valuing Rs94.9tr. These transactions showed a quarterly increase of 3pc by value.

Now the situation has improved and encouraging regarding the Covid-19. “In this backdrop, SBP reviewed the current IBFT pricing mechanism and has made some changes to ensure that free of charge IBFT services are provided by banks and other financial institutions on a sustainable basis,” said the circular.

The central bank said that the new instructions encourage banks to provide free of cost digital fund transfer services to their customers to promote adoption of digital payments in the country.

The SBP has also advised banks that all digital fund transfer transactions between different accounts within the same bank (intrabank fund transfers) shall remain free. Further, incoming interbank fund transfer transactions shall also remain free. SBP has further directed banks to ensure proper disclosure of charged and free IBFT amounts along with applicable fees to their customers by sending regular notifications through SMS, apps and email.

After every digital transaction, banks are required to send free of charge SMS to their customers on their registered mobile numbers intimating them about the transaction amount and the charges being recovered.

You May Also Like

ISLAMABAD: The military has reportedly formed an inquiry committee to investigate allegations of misuse of authority against former

ISLAMABAD: Former prime minister Imran Khan took a potshot at the civil administration on Wednesday over the recent Bahawalnagar