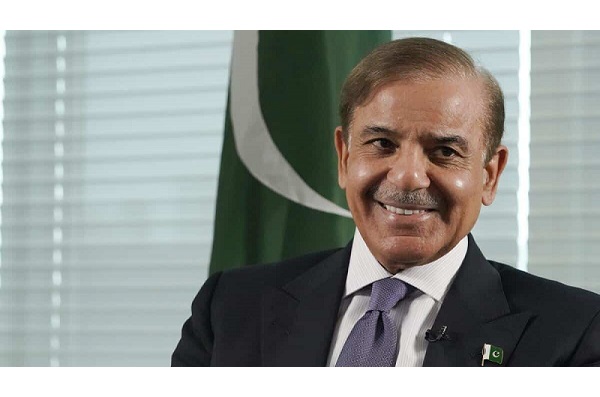

ISLAMABAD: Prime Minister Shehbaz Sharif would be visiting Saudi Arabia for the second time in a month, on April 27 for three days,

The euro fell below 99 cents for the first time in nearly two decades, while sterling was on the ropes on Monday as Russia’s halt on gas supply down its main pipeline to Europe sparked concerns over energy prices and growth.

The euro slid to $0.988 in Asia trade, the lowest level since 2002, while sterling hit a new 2.5 year low at $1.144, and remained close to its pandemic trough.

Meanwhile, the US dollar index, which measures the greenback against a basket of six currencies with the euro the most heavily weighted, hit a new two-decade high, surging to a top of 110.25.

Russia scrapped a Saturday deadline for flows down the Nord Stream pipeline to resume, citing an oil leak in a turbine. It coincided with the Group of Seven finance ministers announcing a price cap on Russian oil.

The pound has also been weighed down by concerns over rising energy costs. British foreign minister Liz Truss said over the weekend she would set out immediate action to tackle rising energy bills and increase energy supplies if she is to become Britain’s next prime minister, as expected.

“We can’t have any confidence in the outlook for natural gas in Europe, and this is a negative for the euro. It heavily depends on Putin,” said Osamu Takashima, Citigroup Global Markets’ chief FX strategist.

The yen, at 140.38 per dollar, was under pressure near a 24-year low. The risk-sensitive Australian dollar slid 0.41 per cent and was near a seven-week low at $0.678.

“The first order effect seems to be that the heightened geopolitical risk and consequent adverse global demand shocks will probably be the effects dominating,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank in Singapore.

“The adverse demand shocks in a very unsavoury geopolitical environment are probably going to trigger, and reflect, safe demand for the U.S. dollar … the European currencies are perhaps going to be the worst hit and on the back foot.”

Outsized rate hikes are on the cards this week. Markets have priced a near 80pc chance of a 75 basis point (bp) hike in Europe and an almost 70pc chance of a 50 bp hike in Australia.

“One would have anticipated that a hawkish ECB (European Central Bank) should deliver some kind of a tailwind to the euro. But instead what you might get is the policy tradeoff and dilemma biting in,” Varathan said.

In the United States, pricing for a 75 bp hike this month has pared back somewhat after a mixed jobs report on Friday, that contained a few hints of a loosening labour market.

You May Also Like

ISLAMABAD: The military has reportedly formed an inquiry committee to investigate allegations of misuse of authority against former

ISLAMABAD: Former prime minister Imran Khan took a potshot at the civil administration on Wednesday over the recent Bahawalnagar