ISLAMABAD: The ruling Pakistan Muslim League Nawaz (PMLN) emerged victorious on most seats in the by-elections, according to

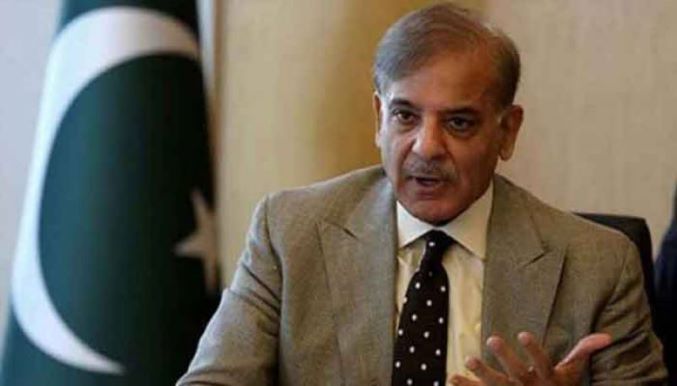

ISLAMABAD: Prime Minister Shehbaz Sharif Wednesday agreed in principle to implement tough decisions in order to break the lingering deadlock with the International Monetary Fund (IMF).

The tough decisions include unveiling a mini-budget for taking additional taxation measures to fetch Rs150-200 billion and hiking the gas and electricity tariffs.

“The premier chaired an online meeting Wednesday evening for around three hours and thirty minutes in which important decisions were taken. However, this meeting is expected to be reconvened on Thursday (today) for taking more crucial decisions,”.

When Minister for Petroleum Musadik Malik was asked about the decision of hiking the gas tariff outside the Ministry of Finance Wednesday night, he did not reply.

The government, the sources said, will have to hike gas and electricity tariffs for the current fiscal year. In the gas sector, the tariff of Rs650 per MMBTU will be increased to Rs1,100 per MMBTU on an average.

Currently, there is a monster of circular debt of Rs1,640 billion out of which the government will recover Rs800 to Rs850 billion through the dividends of two giant gas utilities, including SNGPL and SSGCL.

In the power sector, the government is considering hiking the electricity tariff in the range of Rs4.50 per unit in the first phase and Rs3 per unit in the second phase within the ongoing fiscal year.

The sources said the government envisaged the FBR’s tax collection target of Rs7,470 billion but in December the FBR faced a shortfall of Rs225 billion in achieving the desired target. The collection in line with the IMF’s target was missed out by a margin of Rs82 billion for end December 2022.

The FBR’s internal assessment shows that the tax collection machinery will be facing a shortfall of Rs170 billion for the whole fiscal year, so the tax collection will be standing at Rs7,300 billion against the initially envisaged target of Rs7,470 billion. For netting an additional Rs150 to Rs200 billion in the remaining five months of the current fiscal year, the government will have to take additional measures of Rs300 to Rs400 billion on per annum assumption basis, so there are very difficult decisions which the government will have to take possibly through a presidential ordinance.

The government plans to slap the Flood Levy in order to fetch Rs100 billion, including imposition of levy in the range of 1 to 3 percent for curtailing imports.

Secondly, a levy is also under consideration for slapping 60 to 70 percent tax on lofty profits of banks, which these banks allegedly earned through manipulation of exchange rate.

It is estimated that the banks earned around Rs100 billion extraordinary profits in the first nine months of the calendar year 2022.

The government is also contemplating upon options for increasing the Federal Excise Duty (FED) on sugary beverages, cigarettes and slapping of GST on POL products. In the recent past, Minister for Finance Ishaq Dar sternly opposed any move for slapping 17 percent GST on POL products, arguing that it would be highly inflationary.

You May Also Like

SYRIA: Rockets were fired late Sunday from northern Iraq at a military base in Syria housing a US-led coalition, according to Iraqi security

ISLAMABAD: Iranian President Ebrahim Raisi arrived in Pakistan on Monday on a three-day official visit the first of its kind by any head of