PESHAWAR: The Supreme Court on Monday suspended the Peshawar High Court’s (PHC) verdict denying the Sunni Ittehad Council (SIC)

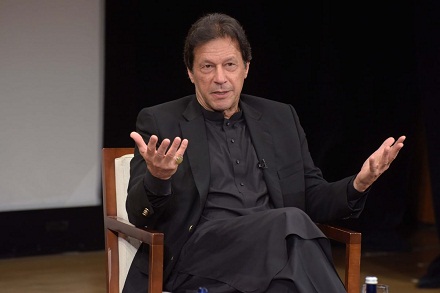

ISLAMABAD: Prime Minister Imran Khan on Tuesday inaugurated a track and trace system (TTS) of the Federal Board of Revenue (FBR). The TTS will help the government monitor the movement of sugar from factories in order to check tax evasion.

The sugar industry has emerged as the second sector after cigarettes to be brought under the electronic monitoring system. The FBR is planning to bring the beverage, cement, fertiliser, iron and petroleum sectors under this system.

Speaking on the occasion, the prime minister said that people had no trust in the tax system of the country, but he did not elaborate on the measures his government had taken for restoring people’s confidence in the tax system over the past three years.

He said that Pakistan was the fifth biggest country in terms of giving charity. “I am the biggest beneficiary of this system,” he said, adding that the people preferred to give charity, but they were not willing to pay taxes.

“FBR will have to play a role in restoring the confidence of the people in the tax system,” he added.

Mr Khan said the biggest problem facing the country was scarcity of resources to run its affairs. “We resort to taking loans for paying our debt and servicing it,” he said, adding that the sustainability of state was at risk.

“We can’t go on like this. We are stuck in vicious circles. We need to go for the use of technology to generate maximum revenue.”

The prime minister said the FBR was expected to collect Rs6 trillion in taxes during the current financial year. Of this, he said, Rs3tr would be used for the retirement and servicing of debts but the remaining amount was insufficient for infrastructure development, and health and education spending in the country.

Mr Khan expressed the hope that the revenue collection figure would reach Rs8tr.

He stressed the need for promoting and strengthening tax culture in the country by assuring the people that their taxes would be spent on welfare of their children and not on the luxuries of rulers.

The prime minister claimed that the TTS would ensure transparency in the tax collection and help restore people’s confidence.

Adviser to the PM on Finance and Revenue Shaukat Tarin said 76 companies had signed up for the TTS so far. The FBR and National Database and Registration Authority were working on broadening the tax base through the use of modern technology, he added.

Mr Tarin said around 15 million people had been identified who could be brought into the tax net.

The TTS will ensure electronic monitoring of the production and sale in tobacco, fertiliser, sugar and cement sectors. This will help bring transparency to the system and enhance the country’s revenue collection.

Under the system, no production bag of sugar will be taken out from the factory and manufacturing plant without a stamp and individual identity mark from Nov 11. The FBR has already notified this through specific rules.

The unique identification markings (UIMs) are to be obtained/procured from FBR’s Licensee AJCL/MITAS/Authentix Consortium.

The Sales Tax Act, 1990, read with Rule 150 ZF of the Sales Tax Rules, 2006, mandates the FBR to notify the date for the implementation of Electronic Monitoring of Production and Sales of Goods in the manner prescribed in the law on all manufacturing sites of notified sectors.

You May Also Like

GAZA: Palestinian militant group Hamas on Monday agreed to a Gaza ceasefire proposal from mediators, but Israel said the terms did not meet

WASHINGTON: A former high-profile agent of the US Federal Bureau of Investigation (FBI), Kamran Faridi has been released from a Florida