ISLAMABAD: PTI’s founding chairman Imran Khan in his message from Adiala Jail, Mr Khan urged the judges hearing his and his wife

NEW DEHLI: India will start withdrawing its highest-value currency notes from circulation, its central bank said on Friday, in a move that economists said could boost bank deposits at a time of high credit growth.

The withdrawal of 2,000-rupee ($24.5) notes — which the finance ministry’s top official, T.V Somanathan, said would not cause disruption “either in normal life or in the economy” — also comes ahead of elections in four large states at the end of the year and a national ballot in spring 2024.

Most of India’s political parties are believed to hoard cash in high denomination bills to fund election campaign expenses to get around tough spending limits imposed by the Election Commission.

Announcing the withdrawal, the Reserve Bank of India (RBI) said evidence showed the denomination was not being commonly used for transactions.

The notes will remain legal tender, it added, but people will be asked to deposit and exchange them for smaller denominations by September 30.

“The stock of banknotes in other denominations continues to be adequate to meet the currency requirement of the public,” the RBI added in a statement.

The 2,000 rupee note was introduced in 2016 after the Narendra Modi-led government abruptly withdrew 500 and 1000 rupee denominations in an effort to remove forgeries from circulation.

There is little evidence that the plan succeeded, but the move did create a systemic shortage of cash by taking away 86 per cent of the economy’s currency in circulation by value overnight.

The government began issuing new 500 rupee notes days later and added the 2,000 to replenish currency in circulation at a faster pace.

However, since then, the central bank has focused on printing notes of 500 rupees and below and has printed no new 2,000-rupee notes in the last four years.

Pronab Sen, economist and former chief statistician of India, called the withdrawal of the higher-value note “a sensible form of demonetisation.”

Karthik Srinivasan, senior vice president of Financial Sector Ratings at ICRA, said banks’ deposit accretion rates “could improve marginally in the near term”.

You May Also Like

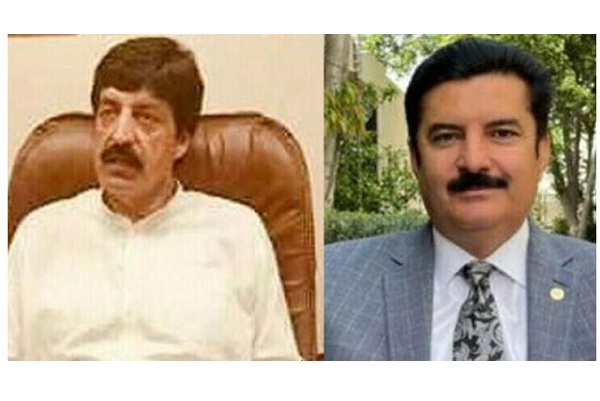

ISLAMABAD: PPP Chairman Bilawal Bhutto-Zardari on Friday nominated two senior party leaders for the posts of Khyber Pakhtunkhwa

UNITED NATIONS: Pakistan has urged the UN General Assembly and the Security Council to address India’s new strategy of